Acquiring a cars and truck is one of one of the most amazing turning points in life, but let's be honest-- it can likewise be a little frustrating. Between picking the right design, considering new versus used choices, and managing financing, it's simple to really feel shed in the process. That's why comprehending just how vehicle financing functions is vital to making wise, certain choices when you're ready to hit the road in your next cars and truck or vehicle.

This overview is here to walk you through the ins and outs of cars and truck funding-- breaking down the terms, supplying real-world insight, and helping you prepare to navigate your purchase like a pro.

The Basics of Vehicle Financing: What You Need to Know

Financing an automobile essentially indicates obtaining cash from a lender to purchase a vehicle. Instead of paying the complete cost upfront, you make regular monthly settlements with time. These settlements consist of both the principal (the cost of the cars and truck) and rate of interest (the expense of borrowing).

Lenders generally assess your credit rating, earnings, employment standing, and existing financial obligation to identify your eligibility and interest rate. The far better your credit history and monetary health, the extra desirable your car loan terms are most likely to be.

It could sound like an easy procedure-- and in lots of ways, it is-- yet there are lots of selections to make in the process that can impact your lasting costs.

New vs. Used: Making the Right Choice for Your Budget

Among the first large decisions you'll encounter is whether to finance a brand-new or used automobile. New automobiles supply that alluring display room shine and the most up to date technology, but utilized vehicles can supply significant savings and usually hold their value better with time.

Numerous motorists favor used car dealership options to extend their budget while still landing a trusted automobile. With licensed previously owned programs and detailed automobile background reports offered, buying utilized has actually ended up being a far more safe and secure and attractive path.

Your funding terms might differ in between brand-new and previously owned automobiles also. Lenders typically provide reduced rate of interest for brand-new cars, however since the rate is greater, your monthly payments may be too. Made use of vehicles may include somewhat higher rates, but the reduced loan amount can help keep payments manageable.

How Loan Terms Affect Your Monthly Payment

When financing an automobile, you'll select the length of your funding-- generally varying from 36 to 72 months. A longer financing term suggests reduced regular monthly repayments, however it also implies you'll pay much more in interest over time.

Much shorter financing terms feature higher monthly settlements however lower overall passion expenses. Finding the right equilibrium depends upon your financial objectives and the length of time you prepare to maintain the automobile.

If you're preparing to sell for a newer model in a couple of years, a shorter term could suit you ideal. If you're aiming for one of the most affordable monthly repayment, a longer term may be a lot more comfortable; simply keep in mind the lasting cost.

Deposits and Trade-Ins: Lowering Your Loan Amount

A smart way to minimize your car loan quantity-- and for that reason your month-to-month payments-- is by making a strong deposit or trading in your current automobile.

Putting down 10% to 20% of the car's rate can considerably boost your funding terms. And also, a strong down payment shows lending institutions you're financially accountable, which can assist you secure a reduced interest rate.

If you're trading in your present auto, that value goes directly toward your new automobile acquisition. Many individuals visit a used car dealership to evaluate the trade-in value of their present experience, helping them spending plan extra accurately for their next purchase.

Understanding APR: What You're Really Paying

The Annual Percentage Rate (APR) is the total cost of borrowing money-- including both the interest rate and any lender fees. It's the true profits when contrasting funding deals, and it's the number you must pay the closest interest to.

A low APR can save you thousands over the life of a car loan. It's worth looking around and getting pre-approved prior to you head to the truck dealership, so you understand precisely what you're collaborating with and can contrast deals with confidence.

Your credit score is a big factor here. If you're not quite where you want to be, take a few months to improve your credit score by paying for financial debt and making consistent settlements-- it can make a large distinction.

Leasing vs. Financing: Which is Better for You?

While this guide focuses on financing, it's worth keeping in mind that leasing is an additional alternative that may fit some buyers. Leasing generally comes with reduced month-to-month repayments and enables you to drive a new car every couple of years.

Nevertheless, you don't own the car at the end of the lease, and there are generally gas mileage limits and wear-and-tear fines. Funding, on the other hand, builds equity-- you possess the automobile outright once the lending is repaid.

For motorists who intend to keep their lorry for the long haul or place a lot of miles on it, funding with a trusted truck dealership is usually the even more financially sound choice.

What to Bring When You're Ready to Finance

Being prepared can speed up the funding procedure and assistance guarantee you get the most effective possible terms. When you head to the dealer, bring:

Your driver's permit

Evidence of insurance

Current pay stubs or evidence of income

Proof of house

Credit history or pre-approval (if offered)

Trade-in documentation (if appropriate)

Having every one of this all set makes it easier to examine various funding options instantly and move on with self-confidence.

Exploring Options for Chevrolet Fans

If you've got your eye on Chevrolet trucks to buy, you're not the only one. These vehicles are known for their toughness, efficiency, and worth-- making them a great fit for both everyday chauffeurs and severe adventurers alike.

Whether you're searching for a durable workhorse or an elegant, road-ready SUV, funding choices can assist make your suitable Chevrolet extra possible. The appropriate truck dealership will certainly walk you through the process, explain every information, and see to it you're obtaining the offer that finest fits your life.

Financing Tips for First-Time Buyers

If this is your very first time funding an automobile, right here are a few fast ideas to bear in mind:

Know your credit history before you go shopping.

Establish a firm budget and adhere to it.

Factor in taxes, costs, and insurance coverage costs.

Do not be afraid to ask questions-- your convenience matters

Think about obtaining pre-approved for financing before checking out a used car dealership

The very first vehicle you fund sets the tone for your future credit possibilities, so take your time, stay educated, and be intentional concerning every step.

Keep Connected and Informed

Vehicle funding doesn't have to be made complex-- and when you're knowledgeable, it can in fact be empowering. Whether you're looking at Chevrolet trucks available, discovering financing for the very first time, useful link or visiting a truck dealership to evaluate your alternatives, the process can be interesting and fulfilling.

Stay tuned for more blog site updates to maintain learning and making the smartest auto choices possible. We're right here to aid guide your journey-- so don't be a complete stranger. Return quickly and drive forward with confidence.

Lark Voorhies Then & Now!

Lark Voorhies Then & Now! Patrick Renna Then & Now!

Patrick Renna Then & Now! Tahj Mowry Then & Now!

Tahj Mowry Then & Now! Amanda Bearse Then & Now!

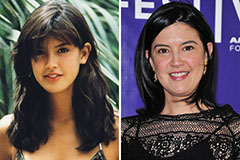

Amanda Bearse Then & Now! Phoebe Cates Then & Now!

Phoebe Cates Then & Now!